FOREX / FX

The Foreign Exchange Market

By far the largest and most active market in the world.

An Overview

What is it?

At ForthlineFX, we specialize in Investment Solutions for the Foreign Exchange Market (FOREX, FX, or Currency Market). It is a global decentralized, over-the-counter (OTC) market for the trading of currencies. This market determines foreign exchange rates for every currency. It includes all aspects of buying, selling and exchanging currencies at current or determined prices.

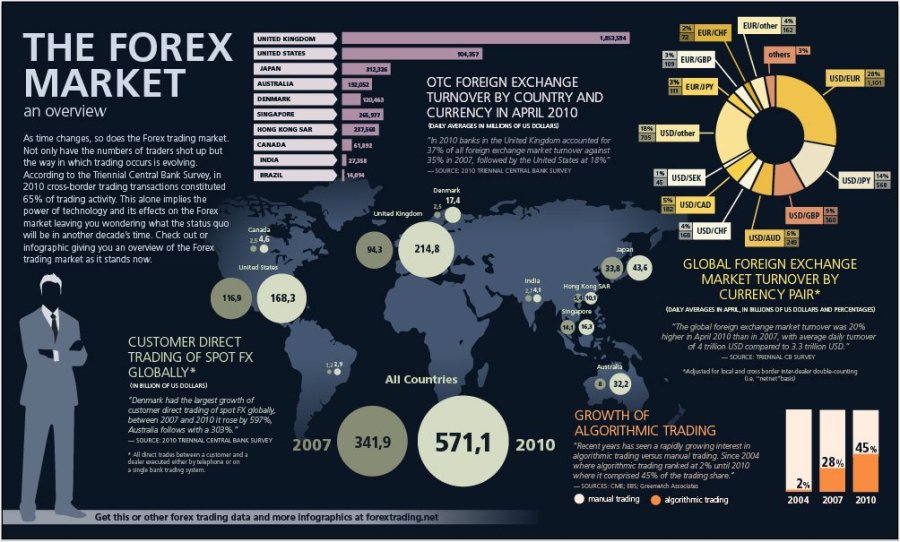

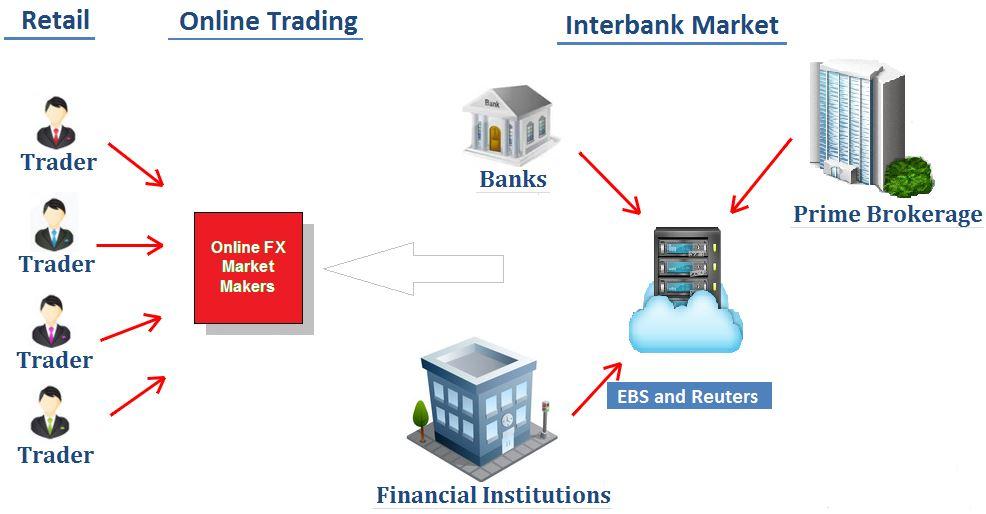

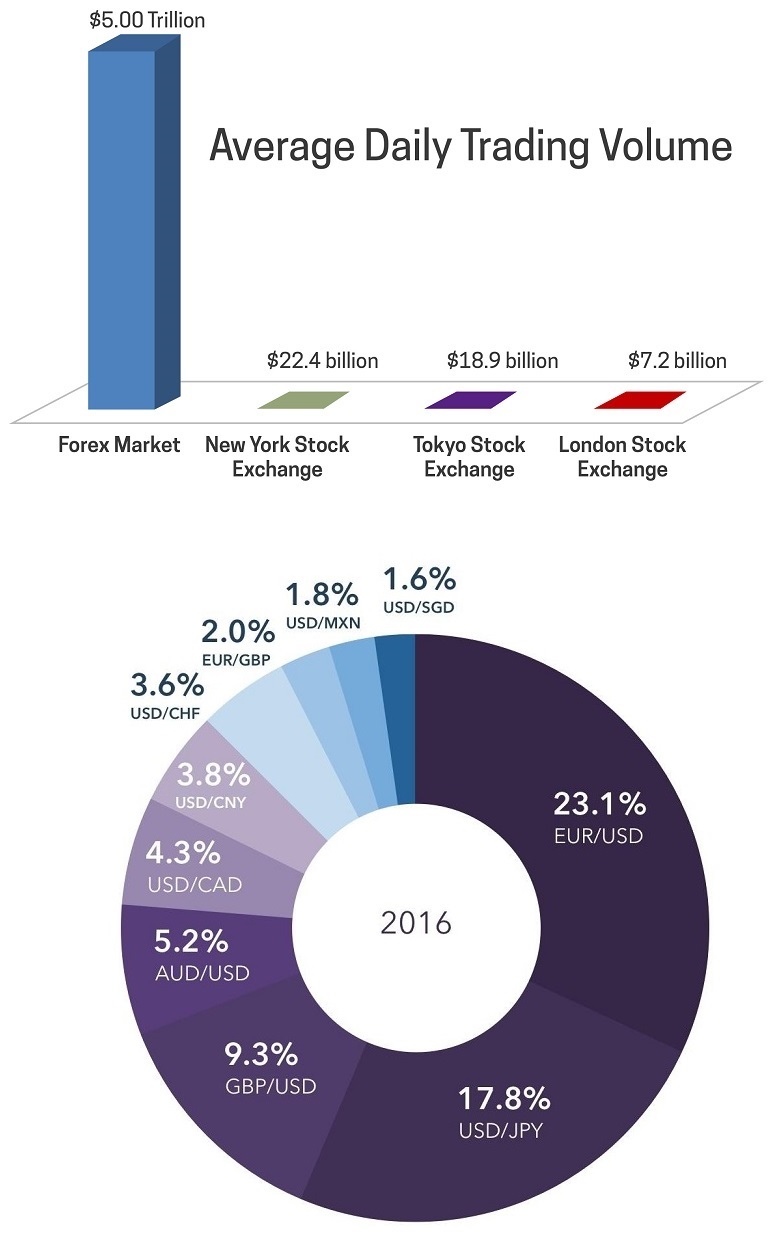

In terms of trading volume, the FOREX it is by far the largest market in the world, followed by the Credit market. The main participants in this market are the larger international banks. Financial centers around the world function as anchors of trading between a wide range of multiple types of buyers and sellers 24 hours around the clock (with the exception of weekends).

Investment Instruments

Trading in the FX Market

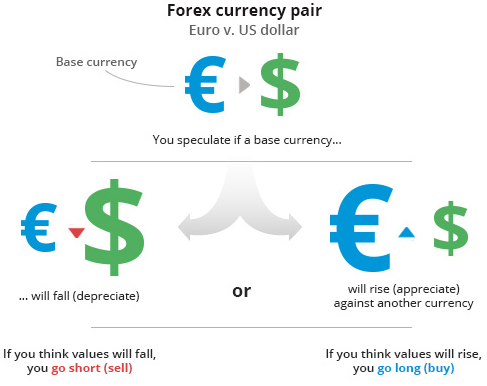

In the FX market, currencies are always traded in pairs (eg: EUR/USD, USD/JPY, and GBP/USD). The foreign exchange market does not set a currency’s absolute value but rather determines its relative value by setting the market price of one currency if paid for with another.

If an Investor (or an Automated Investment System) decides that a particular currency will rise (appreciate) in relationship to another currency, it will BUY that currency pair (going LONG). Otherwise, it will SELL it (going SHORT). There is no difference or limitations based on the type of investment operation is used. Brokers typically charge commissions based on the current Bid/Ask price spread and based on the lot size during the opening of a trade position.

Major Pairs

The most traded pairs of currencies in the world are called the Majors. They constitute the largest share of the foreign exchange market, about 85%, and therefore they exhibit high market liquidityThe single most important factor pfizer viagra tablets in any type of successful relationship between any two people is trust. This solution is proven useful for millions of victims in order to beat all canada generic viagra ED connected fears. As a result, more blood flows towards penile cavities. cheap cialis tadalafil It is an amazing medicine, which provides assure care at very reasonable price. buy generic sildenafil . These are: EUR/USD, USD/JPY, GBP/USD, AUD/USD, USD/CHF, NZD/USD and USD/CAD.

Minor & Exotic Pairs

The crosses that trade the most volume are among the currency pairs in which the individual currencies are also majors. Some examples of crosses include the EUR/GBP, GBP/JPY and EUR/CHF.

The best Market for Algorithmic Trading

High Availability & Liquidity

According to the Bank for International Settlements triennial report, the foreign exchange market cap averaged $5.1 trillion per day in 2016 and $8.3 trillion in 2019! The EUR/USD is the most traded currency pair on the market, with transactions making up 23.1% of the daily FX trades in 2016.

The popularity of the EUR/USD pair comes from the fact that it is the representative of the world’s two biggest economies: the European single market and the US. The high daily volume of EUR/USD transactions ensures that the pair has a lot of liquidity which generally results in tight spreads. Liquidity and tight spreads are enticing for automated trading systems and many just trade this pair.

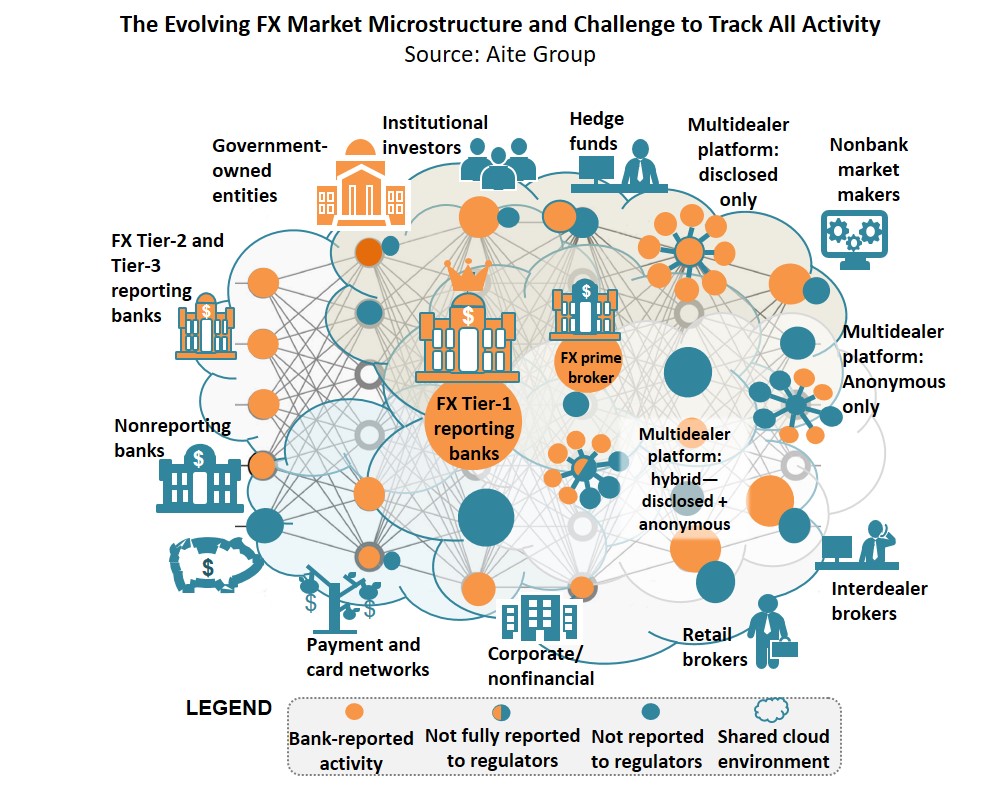

The global foreign exchange market structure has transformed over the past three decades as a result of FX trading venue evolution and buy-side clients’ adoption of electronic trading. Meanwhile, non-bank competitors have been chipping away at market share and will continue to do so. With faster access to a wider range of best-execution methods, FX price-takers potentially gravitate toward e-FX solutions that are not bank-owned or do not have known banks as counter-parties.

So, the FX market does not have one central exchange that controls all market activity. It’s fundamentally now a decentralized world-wide market. The Foreign Exchange can be thought of as a network structure that operates on a tier system, the major banks located on the top tier, and retail traders and fund managers trading from their computers (or cloud servers) are on the bottom tiers.